330+ groups from 50 states, District of Columbia support overturning rule that helps triple-digit interest rate loans bypass state and voter-approved interest rate caps

News Release: March 29, 2021

CONTACTS

Kelly Griffith, Executive Director, Center for Economic Integrity, kelly@economicintegrity.org, (520) 250-4416

Cynthia Zwick, Executive Director, Wildfire, (602) 604-0640; czwick@wildfireaz.org

PHOENIX, AZ – Wildfire and the Center for Economic Integrity applaud plans by Senators Chris Van Hollen (D-MD), Sherrod Brown (D-OH) and Congressman Chuy García (IL-4) to introduce Congressional Review Act (CEA) resolutions eliminating a Trump-era regulation that helps lenders charging 179% APR or more evade state- and voter-approved interest rate caps.

Issued by the Office of the Comptroller of the Currency (OCC), the rushed “fake lender” rule took effect in December. It protected “rent-a-bank” schemes enabling predatory lenders (the true lender) to launder their loans through a few rogue banks (the fake lender), which are exempt from state interest rate caps. The rule overrides 200 years of case law allowing courts to see through usury law evasions, replacing it with a pro-evasion rule that looks only at the fine print on the loan agreement.

Wildfire and the Center for Economic Integrity of Arizona have joined a broad coalition of 338 organizations from all 50 states and the District of Columbia calling on Congress to overturn the “fake lender” rule, which threatens to “unleash predatory lending in all 50 states.” According to national polling, two-thirds of voters (66%) are concerned about the ability of high-cost lenders to arrange loans through banks at rates higher than state laws allowed.

“Arizona voters were very clear in 2008 that triple digit interest rate loans should not be legal in our state, voting by a 60-40 percent margin to get rid of payday lenders. The fake lender rule allows these predators to once again inflict devastating financial harm on our most vulnerable community members,” says Kelly Griffith Executive Director Center for Economic Integrity.

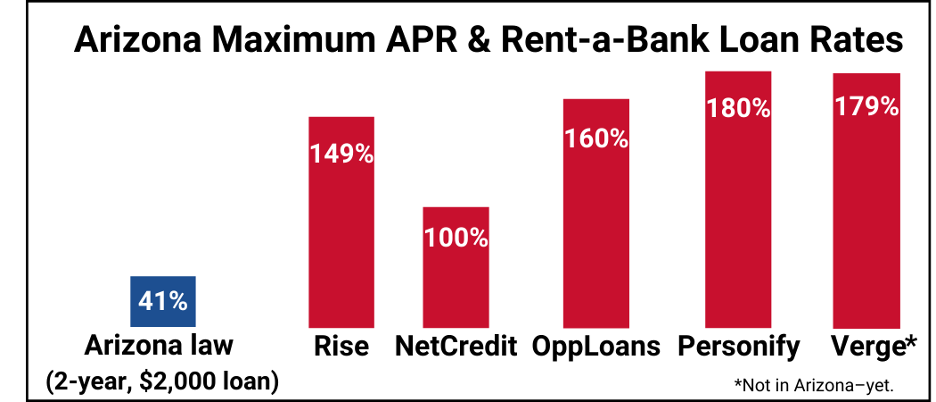

Predatory lenders charging 100% to 200% APR are already starting to push high-cost installment loans in Arizona that exceed rates permitted under Arizona law. Others, including payday lenders, plan to expand to states that do not allow their high-cost loans.

“Arizona law caps the annual interest rate on a $2,000, 2-year loan at 41%. But several high-cost online installment lenders are offering loans in Arizona at rates up to 160% or higher by putting an obscure bank’s name on the loan agreement,” said Wildfire Executive Director Cynthia Zwick. “There is no other way to define or describe that than as a pure, appalling example of predatory lending.”

As was done more than a dozen times under President Trump, Congress could use the Congressional Review Act to rescind recently finalized regulations, including the OCC’s “fake lender” rule, with a majority vote in both chambers, limited debate, no filibuster and the president’s signature. The resolution rescinding the “fake lender” rule must be voted upon by a certain date, currently estimated between May 10 and May 21.

The coalition of signatories to the letter includes civil rights, community, consumer, faith, housing, labor, legal services, senior rights, small business, student lending, and veterans organizations. The full text of the letter can be found here.

A 2-page explanation of the “fake lender” rule is here, a brief explaining how these predatory lenders target veterans is here and a “watch list” of predatory lenders evading state interest rate limits is here.

For more information about Wildfire, visit www.wildfireaz.org For more information about the Center for Economic Integrity, visit https://economicintegrity.org.

###